Are you an options investor looking to potentially maximise returns and reduce risk? Are you aware of how Theta, the time decay rate of an option, can affect your portfolio, both positively and negatively? If so, then this article is for you. We will explore various strategies savvy investors can use to manage their Theta exposure and optimise their investments proactively.

You’ll learn how to hedge against losses and leverage value out of your options when prices start shifting against you. Additionally, we’ll talk about how minor adjustments at the margin can tremendously impact your returns over time – demonstrating why it pays off to stay ahead of the curve.

What is Theta risk, and why should option investors be aware of it

As an option investor, you need to be aware of several types of risk. One of these is theta risk, which refers to the impact of time decay on the price of an option. Essentially, as an option gets closer to its expiration date, its value decreases, which means that the option’s cost also falls. It can significantly impact the profitability of your trades, particularly if you’re an options trader who relies on short-term positions.

To mitigate the impact of theta risk, it’s essential to have a sound understanding of the stock market and the factors that influence the price of options. By doing this, you’ll be better equipped to identify and manage that risk, which can help you make more informed and lucrative decisions. Theta in the stock market can be a double-edged sword – while it can work against you, it can also be leveraged to your advantage.

Types of theta risk associated with options trading

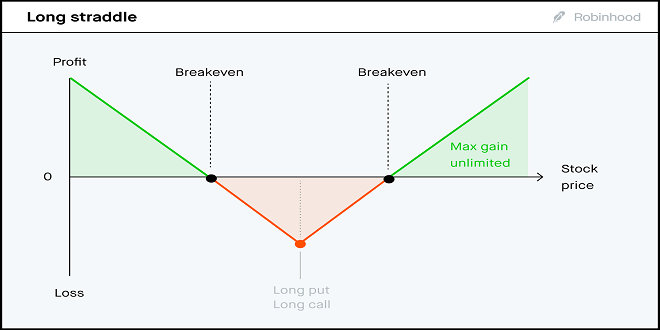

Option investors need to be aware of two types of theta risk: long Theta and short Theta. Long Theta refers to a situation where an investor is long on options, which means they have purchased an option contract. This position exposes the investor to negative time decay (Theta), as the option’s value will decrease as it gets closer to its expiration date.

On the other hand, short Theta refers to a situation where an investor is short on options, which means they have sold an option contract. In this case, the investor is exposed to positive time decay (Theta), as they will benefit from the decrease in the option’s value as it expires. However, this position also comes with increased risk, as the investor must fulfil the terms of the option contract if the buyer exercises it.

Analysing the impact of changes in market conditions on theta risk

Understanding how changes in the market can affect theta risk is crucial for options investors. In general, when volatility increases, so does Theta – which means that time decay accelerates. It means that investors who are long on options may see a decrease in their returns or an increase in their losses as the expiration date approaches. On the other hand, investors who are short on options may see an increase in their returns or a decrease in their losses.

Conversely, when market volatility decreases, theta risk also decreases. It means that time decay occurs at a slower rate, which can positively impact the profitability of options positions for investors who are long on options. For investors who are short on options, this may result in a decrease in returns or an increase in losses.

Strategies to reduce theta risk when trading options

One of the most effective ways to manage theta risk is through diversification. By spreading your investments across various options contracts, you can reduce your overall exposure to theta risk. It means that if one option contract experiences significant time decay, the impact on your portfolio will be limited because it is just one small piece of your overall investment strategy.

Another approach is actively managing your positions by regularly monitoring market conditions and adjusting as needed. For example, if you’re long on options and market volatility increases, consider selling your position or adjusting the strike price. Similarly, if you’re short on options and market volatility decreases, you may want to buy back the option or change your position to mitigate potential losses.

The importance of hedging and diversifying your portfolio to manage Theta risk

As an options investor, it’s essential to understand and manage the risk and hedge against other types of market risk. Hedging involves taking on positions that offset potential losses in your portfolio, thereby reducing overall risk. It can be achieved through various strategies, such as buying put options or using stop-loss orders.

In addition to hedging, diversification is another critical element in managing theta risk. By diversifying your portfolio across different industries, sectors, and asset classes, you can reduce the impact of market volatility on your investments. It means that even if one sector or industry experiences a downturn, your overall portfolio will be less affected as it is not solely reliant on that particular market.

Naasongs.fun

Naasongs.fun